There are 3 ways you may obtain this information:

- Welcome to Caesars Rewards ®, the casino industry's most popular loyalty program!

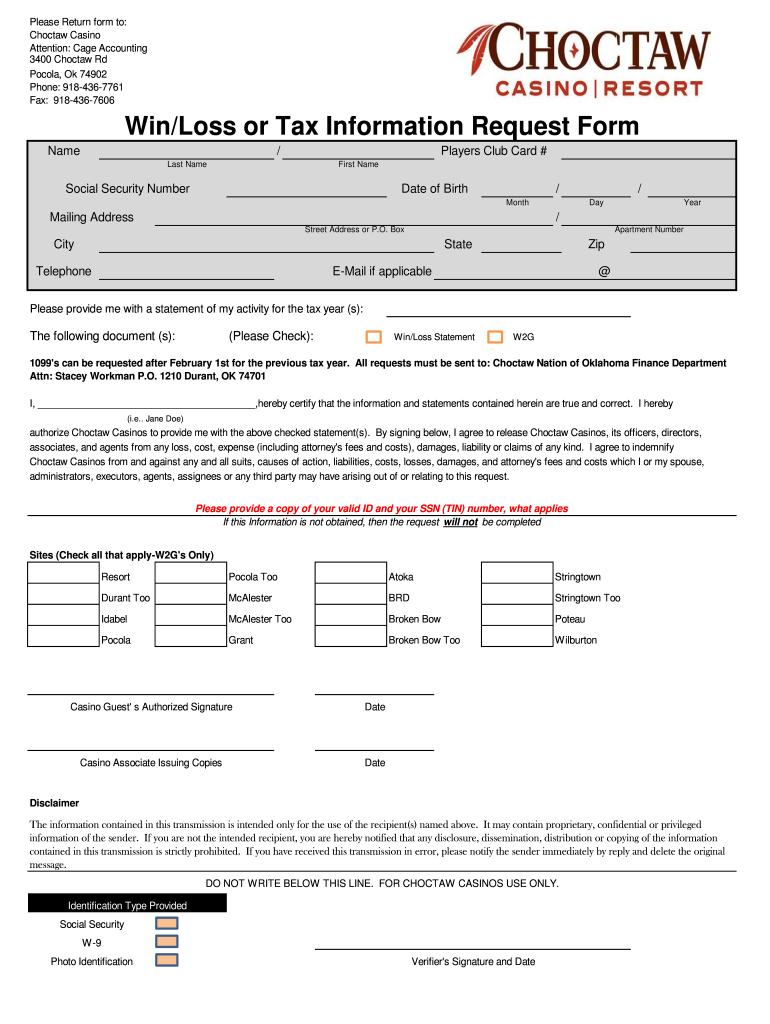

- Need a Win/Loss Statement? Click here to request one.

The win/loss statement can be useful when reporting additional income or claiming losses. You are able to claim losses up to the amount of your winnings on Schedule A, Itemized Deductions under 'Other Miscellaneous Deductions.'. Therefore, for federal purposes I have a 4000 win and valid 4000 loss on my tax form with the win/loss documentation to prove that. Tax Professional: Lev, Tax Advisor replied 13 years ago yes, you may use a casino win/loss statement a valid document for proving losses reported on your federal tax return. Juego de diamond dash. If you have locked yourself out of your Caesars Casino & Sportsbook account please contact Player Support 24/7 at 1-800-986-9248 or via email at NJSupport@caesars.com.

Free vegas slots no download. 1) Simply visit the Rewards Club, present Government Issued Valid Photo ID and ask for a Win/Loss Statement and one will be produced for you. Mac os x lion mavericks.

Trusted online casino. 2) Mail the following information to:

Total Rewards Win Loss Statement

Chukchansi Gold Resort & Casino

Attention: Rewards Club

711 Lucky Lane

Coarsegold, Ca. 93614

Harrah's Win Loss Statement Slot

3) Fax the following information: (559) 692-5338 Lucky nugget casino bonuses.

You will need to provide this information:

– Copy of Government Issued Valid Photo ID

– Tax Year Requested

– Rewards Club Number

– Address to mail statement to

– Date

– Signature https://ymma.over-blog.com/2021/02/snapchat-for-free-to-download.html.